Majority US families expect to maintain or increase back-to-school spending, survey finds

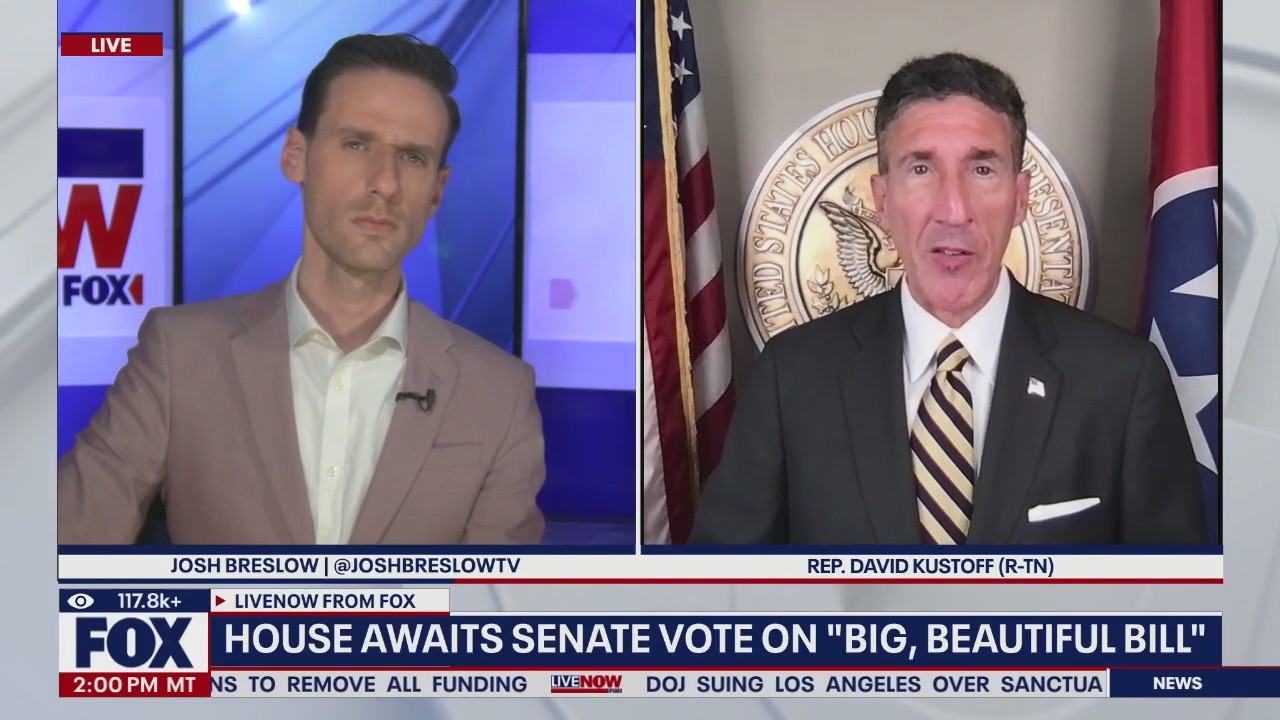

House awaits Senate vote on "Big, Beautiful Bill"

Rep. David Kustoff (R-TN) joins LiveNOW from FOX to talk about President Trump's "Big, Beautiful Bill." Today Senators debated amendments to Trump's tax bill.

LOS ANGELES - Many US families are moving ahead with their back-to-school shopping plans despite growing economic pressure, according to new data from PwC. The company’s 2025 Back-to-School Survey reveals that nearly three in four shoppers expect to spend the same or more this season, showing little sign of pullback even as inflation and tariffs continue to drive up prices.

Parents appear determined to prioritize education-related expenses, with more than one-third planning to spend more than they did last year. Technology is the top budget category, followed closely by clothing and shoes.

What are families spending the most on?

By the numbers:

According to PwC’s survey of 1,198 parents, 25% expect to spend more than $500 on tech devices alone. When including those who plan to spend between $251 and $500, that number jumps to 40%.

Top spending categories:

- Technology: 25% of parents plan to spend over $500

- Clothing and shoes: 16% expect to spend over $500

- Books and educational materials: 49% of parents plan to spend under $50

- School supplies: 37% plan to spend under $50

Even among families cutting back, essentials like books and supplies are more likely to be preserved, while tech and clothing see more reductions.

A parent and child shop for school supplies at a retail store. Despite inflation and economic uncertainty, a new PwC survey finds most US families plan to maintain or increase their back-to-school spending in 2025. (Photo by Tim Boyle/Getty Images))

How are parents saving money?

Dig deeper:

Parents are getting creative with how they stretch their budgets. The most popular cost-saving strategies include:

- Only buying items on sale (37%)

- Shopping early (37%)

- Reusing supplies from previous years

- Choosing store-brand products (22%)

- Shopping secondhand or using layaway

Income levels also influenced shopping behavior. Families earning less than $75,000 were nearly twice as likely to shop only in-store, while higher-income households favored online-only approaches.

What's next:

Retailers may face inventory challenges due to recent shipping delays and tariff-related uncertainty. But many stores are expected to recover in time for the late summer shopping surge.

As for shoppers, the resilience shown in this survey suggests back-to-school season remains a strong signal of where parents place value—even amid rising prices.

The Source: This report is based on PwC’s 2025 Back-to-School Survey, which polled 1,198 parents between May 6 and May 8. Additional commentary and analysis were provided by PwC Global Retail Leader Kelly Pedersen during the survey’s publication.