How to save on car insurance amid rising premiums, according to Allstate

Car insurance costs have risen significantly in recent months, even outpacing record-high inflation, according to recent data. Here are a few ways to potentially save on your auto insurance policy. (iStock)

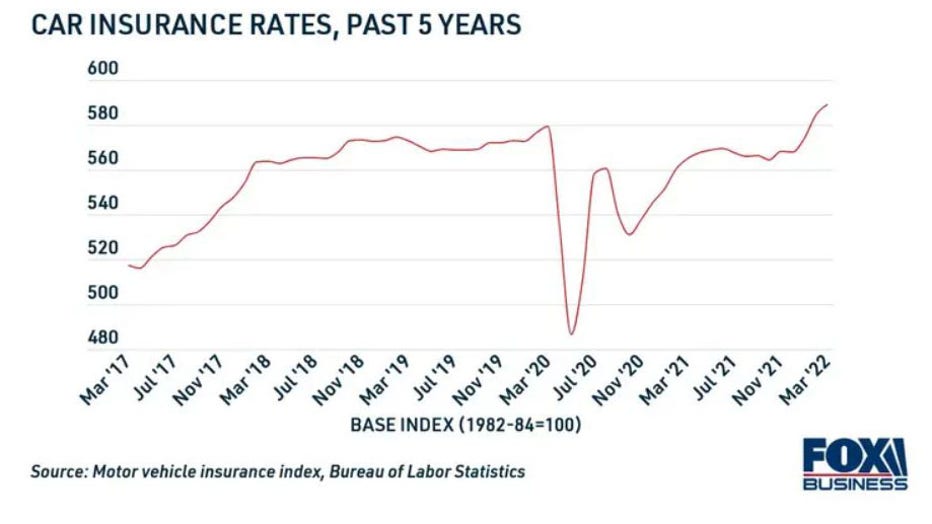

Mounting inflation has consumers paying more at grocery stores and gas pumps, but some rising costs are felt in subtler ways. Data shows that car insurance premiums are currently outpacing inflation, which means drivers may experience sticker shock when it's time to renew their policy — likely at a much higher rate.

Average car insurance rates have risen 3.75% in 2022 alone, according to the Consumer Price Index (CPI). Despite this sharp increase, the Insurance Information Institute (Triple-I) said that premiums aren't "skyrocketing." Instead, they're returning to pre-pandemic levels as policyholders resume their typical driving habits.

During the COVID-19 lockdown, some U.S. employees started working remotely and were driving fewer miles. This led to sudden rate drops in spring 2020 as insurance companies responded to an unforeseen change in American driving habits.

But drivers are now hitting the road more often as restrictions are lifted, which has caused accident frequency and severity to rise, Triple-I reported. Additionally, replacement parts are becoming more expensive due to inflation and supply chain issues. As a result, auto insurers have had to raise premiums to offset loss ratios and stay profitable.

To help consumers offset rising costs, Allstate has shared ways to save money on auto insurance. Keep reading to learn more about how to lock in cheaper car insurance, and visit Credible to compare free rate quotes without impacting your credit score.

82% OF CAR BUYERS PAID ABOVE STICKER PRICE FOR NEW VEHICLES IN JANUARY

Allstate: Tips for saving money on car insurance

Auto insurance companies set premiums based on the coverage type, deductible amount and your risk rating, which includes:

- The zip code and state where you live

- Your age, gender, marital status and credit score

- The make and model of your vehicle

- Your vehicle's use and average miles driven

- Your driving record, including accidents and speeding tickets

- Any previous insurance claims you've filed

Given these eligibility requirements, there are several ways to cut your auto insurance costs, according to Allstate. Read about each money-saving strategy in the sections below.

1. Bundle your auto and home insurance

If you have more than one type of insurance policy, such as homeowners insurance or renters insurance, you might qualify for a multi-policy discount through a single carrier. Credible estimates that drivers can save up to 30% by bundling their home and auto policies.

RETIREES STRAINED BY HIGHER HOME INSURANCE RATES IN FLORIDA

2. Seek out insurers that offer low mileage discounts

Leisure drivers and remote workers may be eligible for usage-based insurance (UBI), which allows you to pay based on the average number of miles you drive. To determine your mileage, insurance companies may require you to install a plug-in device that tracks your driving behavior.

Similarly, some car insurance companies offer discounted insurance that rewards safe driving habits. It uses similar technology that can be used through a mobile app or tracking device that monitors speeding, quick acceleration and hard braking.

DRIVERS IN THIS STATE WILL RECEIVE A $400 CAR INSURANCE REFUND CHECK

3. Review your policy for additional car insurance discounts

Insurance carriers typically offer a number of discounts for paying your premium in full upfront, enrolling in automatic payments or completing a safe driving course. Some companies also offer discounts for installing an anti-theft device, such as GPS tracking systems.

In addition to these measures, drivers may be able to save hundreds by shopping around. Get at least three rate quotes from different auto insurers based on different types of coverage to find the lowest premiums possible for your financial situation. You can visit Credible to check out car insurance quotes for free.

HOME INSURANCE RATES ARE OUTPACING INFLATION — AND THEY'RE NOT LIKELY TO SLOW DOWN

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.