Getting life insurance while you're young and healthy can save you thousands

The longer you wait to lock in a life insurance premium, the higher your monthly rate will be. Find out how taking out life insurance while you're young and healthy can save you thousands of dollars. (iStock)

Life insurance policies provide financial security for your spouse and other beneficiaries if you pass away unexpectedly. Because life insurance companies consider you less likely to die when you're younger, premiums are much cheaper when you're younger, and vice versa.

This means that consumers can save thousands of dollars over time by taking out a life insurance policy at a younger age instead of waiting until they're older. Life insurance premiums typically rise every year with a person's age — so the longer you wait to take out a policy, the more you will pay for life insurance.

Keep reading to see how much you can save by taking out a policy when you're young and healthy. You can visit Credible to compare life insurance quotes from multiple life insurance companies at once for free.

5 WAYS TO TAP INTO YOUR LIFE INSURANCE POLICY'S CASH VALUE

Young adults can save $10,000+ by purchasing life insurance

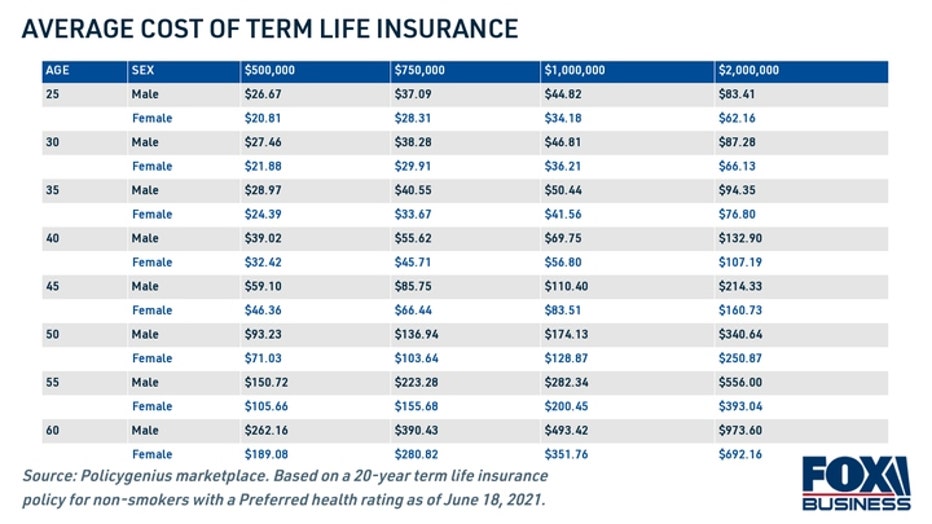

Life insurance premiums are a small price to pay for financial peace of mind. If you take out a policy when you're in your 20s or 30s, you may pay as little as a dollar a day for a six-figure death benefit, depending on the type of life insurance you choose, according to Policygenius data. But the longer you wait into your 40s and 50s, the higher those monthly premiums can be.

For example, a healthy, 35-year-old man could purchase a 20-year term life insurance policy worth $1 million for about $50 per month, the data showed. But if he waits until he's 45 to buy life insurance, his monthly premiums would be over $110.

WHOLE LIFE POLICY OR TERM LIFE POLICY: HOW TO DECIDE WHAT'S RIGHT FOR YOU

By purchasing life insurance at a younger age instead of waiting until he's older, the man could save about $14,400 over the lifetime of the policy. For a woman in the same circumstances, the savings would be more than $10,000.

If the man in our example has enough foresight to buy a term policy at age 30, versus age 45, his monthly premium would be even cheaper at $47. This would allow him to save more than $15,000 over time.

Of course, it may not be worthwhile to borrow a policy when you're that young. Taking out a policy earlier also means it will expire when you're at a younger age.

You could also consider taking out a longer-term life insurance policy if you're looking to lock in a low rate while you're young. For example, you could take out a 30-year term policy at age 35 and be covered until retirement age when you're 65. By then, your dependents may be more financially self-sufficient, erasing the need for a large life insurance payout.

Visit Credible to view plans and life insurance rates from multiple insurers so you can find the best life insurance policy for your needs.

IS PERMANENT LIFE INSURANCE A GOOD IDEA FOR YOU?

How to determine your life insurance coverage needs

Young adults are likely to have a wide variety of financial responsibilities, especially if they've already started a family and have multiple dependents. Here's how to decide the policy amount you need to take care of your beneficiaries:

- Determine how much debt you have. Consider your federal and private student loans, credit card debt and mortgage, as well as any future debts you may incur during the course of the policy.

- Tally up your monthly income and expenses. Your policy amount should be enough to replace your income and cover everyday purchases for a set number of years.

- Subtract your debt and expenses from your income. Don't forget to consider other costs associated with accidental death, such as funeral costs.

Once you know the size and term life policy you need, you can get free term life insurance quotes on the Credible marketplace.

TERM VS. WHOLE LIFE INSURANCE POLICY: WHICH IS RIGHT FOR YOU?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.