Is it better to rent or own in NYC?

NEW YORK, NEW YORK - NOVEMBER 4: Traditional tenement buildings are now expensive rental apartments, November 4, 2022 on Orchard Street in the Lower East Side neighborhood of New York City, New York. (Photo by Andrew Lichtenstein/Corbis via Getty Ima

NEW YORK - New York City is a city of renters, especially compared to the rest of the nation. As difficult as renting can be in the city, purchasing a home is all the more daunting.

With the city's ongoing affordability crisis reaching new levels and vacancy rates at historic lows, living in the city is an ongoing challenge.

According to a recent report, finding an NYC apartment to rent for under $2,400 is nearly impossible.

For those looking to buy a home, average mortgage rates are around $3,460.

While rental affordability has gotten worse in the city, price escalation is even worse in the housing market.

Is it better to rent or own in New York City?

Click here for the answer or keep on scrolling.

Renting in New York City

Living in the city comes at a price – and it isn't cheap.

Rents across New York City have soared driving the affordability crisis to record highs.

A report by the NYC Department of Housing Preservation and Development showed that renters have less than a 1% chance of finding an apartment that costs under $2,400 a month in the city, with the city's overall vacancy rate reaching a historic low of 1.4%.

Featured

NYC rent rollercoaster hits new record highs in Manhattan, Brooklyn, Queens

Median rents in Manhattan, Brooklyn and northwest Queens have once again hit record-setting highs, up from 2023.

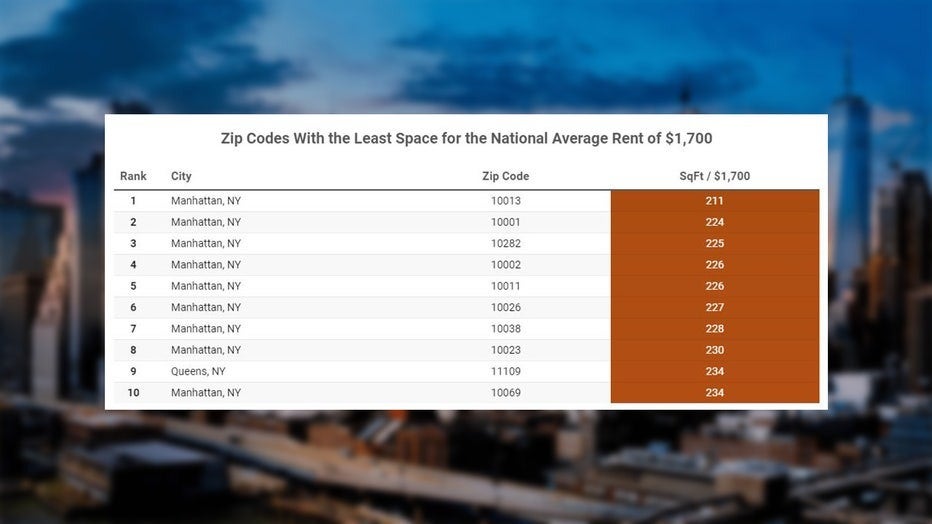

A new study by RentCafe showed that $1,700 a month, barely gets you an area the size of a living room.

The same amount in Memphis, Tennessee gets you 1,996 square feet of space.

In Manhattan, Brooklyn, and northwest Queens, median rents have vaulted to record-smashing highs.

Credit: RentCafe.com

Manhattan rent prices

Manhattan median rents are now $4,230, up from $4,095 this time last year and 20.9% higher than pre-pandemic levels.

Even with concessions, the median rental price is $4,198, with the borough's vacancy rate standing at just 2.49% according to the latest analysis by the Elliman Report.

Average rental price: $4,886 (Elliman Report)

Brooklyn rent prices

Brooklyn isn't any better. The median rent stands at a stubbornly high rate of $3,499, 2.9% more than in February of 2023.

Prices are still 20.9% higher than they were before the pandemic.

Average rental price: $3,814 (Elliman Report)

Queens rent prices

In Northwest Queens, median rent prices are roughly unchanged from last year but up 1.2% from January 2024, to $3.239, still 11.7% higher than before the pandemic.

Average rental price: $3,368 (Elliman Report)

Buying a home in NYC

How does New York compare to other major cities for homeowner affordability? Not very well.

NYC Mayor Eric Adams created a goal to build 500,000 new homes over the next decade, but a series of complications in Albany have prevented any significant progress.

According to consumer financial services company Bankrate, Americans need an annual income of $110,871 to afford a median-priced home of $402,343.

To find out how Bankrate calculated the study, click HERE.

In New York the average annual income needed to afford a median-priced home is $148,286.

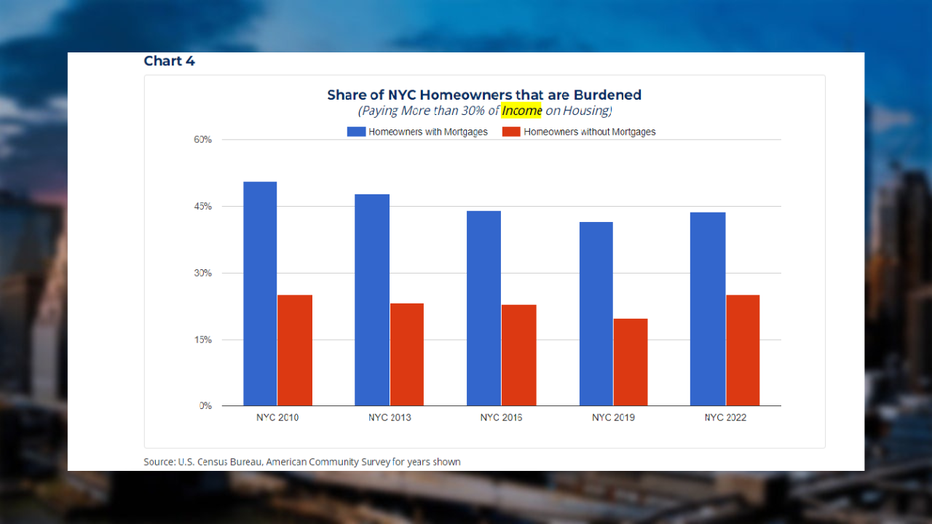

According to the New York City Comptroller, only about 30% of all NYC households own their homes, and these homeowners span the income spectrum.

Based on data from StreetEasy, the median sales price for homes that sold in 2024 was $785K.

See list of open houses from StreetEasy here.

New York State home prices

- Annual income needed to afford a median-priced home (Jan. 2024): $148,286

- Monthly mortgage payment (Jan. 2024): $3,460

- Median home sale price (Jan. 2024) New York: $521,800

Answer: As expensive as it is to rent a home in the city, buying a home tends to be even more stratospheric.